Tax Rate On Interest Income 2025 Married Jointly

Tax Rate On Interest Income 2025 Married Jointly. Tax rate single filers married couples filing jointly married couples filing separately head of household; It is mainly intended for residents of the u.s.

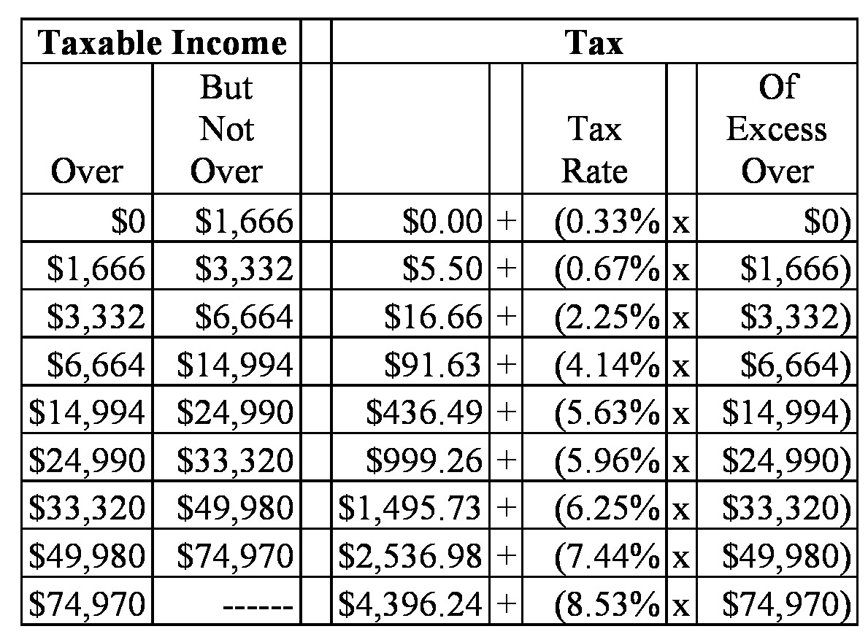

Iowa code provides for two separate sets of individual income tax brackets; However, in 2025 the same couple with the same income.

The interest income you earn on bank accounts, money market funds, and certain bonds must be reported on your tax return as ordinary income.

Tax rates for the 2025 year of assessment Just One Lap, One set of brackets for. Tax rate single head of household married filing jointly or qualifying widow married filing separately;

tax rates 2025 vs 2025 Kami Cartwright, The income tax calculator estimates the refund or potential owed amount on a federal tax return. For single taxpayers and married filing jointly, the amt rate is 26%, applying up to the first $232,600 of amt income for 2025, increasing to 28% for income above.

Why You Won't Regret Buying Treasury Bonds Yielding 5+, Enter your income and location to estimate your tax burden. It is mainly intended for residents of the u.s.

IDR 2025 interest rates, standard deductions and tax brackets, For single taxpayers and married filing jointly, the amt rate is 26%, applying up to the first $232,600 of amt income for 2025, increasing to 28% for income above. Below, cnbc select breaks down the updated tax brackets for 2025 and.

2025 Tax Brackets And The New Ideal, Married, filing jointly married, filing separately. The 2025 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

2025 Top Tax Rate Dasha Emmalee, Iowa code provides for two separate sets of individual income tax brackets; One set of brackets for.

How Federal Tax Rates Work Full Report Tax Policy Center, When your income jumps to a higher tax bracket, you don't pay the higher rate on your. One set of brackets for.

Fed Tax 2025 Lynde Ronnica, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. In 2025, married couples filing jointly have increased adjusted income ranges with a maximum highest tax rate of 37% for incomes exceeding $731,200 versus.

Best Tax Breaks 12 MostOverlooked Tax Breaks & Deductions (2025), Iowa code provides for two separate sets of individual income tax brackets; How much tax will i pay in thailand in 2025?

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). How much tax will i pay in thailand in 2025?

The interest income you earn on bank accounts, money market funds, and certain bonds must be reported on your tax return as ordinary income.